Healthcare payments automation and reimbursement company Payspan has secured a new investment from private equity firm Primus Capital.

The size of the round is undisclosed.

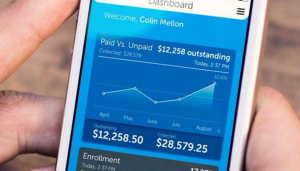

Atlanta-based Payspan provides payment automation services to help payers and healthcare providers improve administrative efficiency and meet regulatory requirements.

The company claims its SaaS platform is used by 650 major health plans, 1,300,000 provider payees and 107 million consumers.

Payspan’s CEO Rex Adams said: “As the healthcare reimbursement model continues to get more complex, Payspan is in a unique position to work collaboratively with payers and providers to solve the most difficult financial challenges facing the market today and in the future.”

The company says it will use the new capital to expand its product portfolio to address developing challenges in healthcare reimbursement.

It will also invest in expanding its marketing and sales initiatives to drive customer engagement.

Primus managing partner Phil Molner said: “we are particularly excited about the company’s growth prospects to leverage the rapidly changing reimbursement landscape in healthcare as a competitive advantage to drive business outcomes.

“We are confident that our partnership with Payspan will enhance its position as a market leader and fuel further innovation that will benefit customers.”

The firm’s principal Chris Welch further highlighted the potential for collaboration between Primus and Payspan saying it’s a “clear fit for our healthcare technology portfolio and will benefit from the synergies and growth capital we bring to the business.”

He added: “We look forward to working with the current management team to grow the business by accelerating investment in developing new solutions and growing the customer portfolio.”

Payspan previously raised $3m in an August 2015 venture round.

Copyright © 2017 FINTECH GLOBAL