Martin Grimwood, GfK Divisional Director – Life, Pensions & Investments

Robo-advice has gained some traction in the US and Australia, but our research shows that when it comes to investments, consumers still value human interaction. Now the UK’s financial regulator is looking to robo-advice to close the country’s widening “advice gap”. Will consumers learn to trust machines for their financial advice, or will the move to “bionic advice” be preferred? Learning from the UK and the US experience, here’s our point of view.

The FCA rushes to robo-advice

The UK regulator for investments and general insurance, the Financial Conduct Authority (FCA), has been leading the charge to robo-advice. Following the introduction of stringent rules on selling in the Retail Distribution Review (RDR), a financial advice gap seems to have emerged. Early in 2016, the FCA said that up to 16 million mass market investors could be trapped by this gap. The reasons include the high cost of advice, low confidence with financial matters and a lack of trust following high-profile mis-selling cases. Now the FCA is looking to new technologies – such as robo-advice – to help drive down the costs of supplying advice and enable firms to engage with mass market consumers more effectively. The regulator has moved quickly by establishing a sandbox and innovation hub to make it easier for brands to launch robo-advice solutions.

In response, two alternative approaches seem to be emerging in the UK: Nationwide is adopting a robo-advice model with a human touch, while Barclays develops a technology driven web-based interface. Nationwide, a member of the FCA innovative hub, launched its pilot early in October, where customers go through an automated process and receive a personal recommendation, assisted by a financial planning manager. More recently, Barclays launched their Smart Investor web-based robo-advice solution, where webpages guide users through learn, plan and invest stages (with access to web chat and call centre support if needed).

Plugging the advice gap

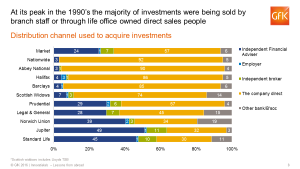

Sales of investments peaked in the late 1990s. According to our Financial Research Survey (FRS), two thirds of these investments were sold via branch staff or through life insurance employees. Sales declined significantly in the early 2000s, coinciding with the fall in staff selling these products. But the decline didn’t impact all consumers equally. It was the mass market segment, with investments worth £20,000 or less, that suffered the most pronounced fall – the group robo solutions are designed to attract – while those with larger sums remained the same. For those who remember the 80s and 90s, you will be familiar with the adage that investments and insurance are “sold not bought”. Tracking their rise and fall over more than two decades, the FRS shows that this saying is still true today. All our research suggests that merely providing access to robo-advice won’t be enough to plug the advice gap in the UK. Consumers – and the mass market segment in particular – need advice or at least guidance to direct them to investments as a viable savings vehicle, and then to reassure them that these investment decisions are right for them.

Lessons from the US: It’s time to talk bionic

The US financial markets have more experience of robo-advice. The market was created by innovative tech start-ups offering low cost asset management via a purely digital interface. The banking sector quickly followed suit – with giants such as Charles Schwab, BMO and Vanguard all acquiring online portfolio management systems in 2015. But rather than encouraging the mass market to invest, the solutions became commoditized as current and more sophisticated investors adopted them to reduce their annual management charges. In other words, rather than creating a new market, an existing one was cannibalized.

Research carried out in June 2016 by GfK in the US indicated that only 4% of respondents would consider robo-advice for investments. Trusting the advice of a computer was by far the biggest barrier for 90% of respondents. Almost two thirds (63%) of respondents agreed that “it would be important to have someone to call on the phone for guidance” when considering to adopt robo-advice. Increasingly, providers such as asset manager Vanguard and Invesco Perpetual are moving to “bionic” advice, where robo-advice is combined with a human touch.

Are investors putting their money where their mouth is?

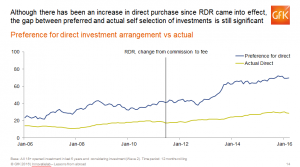

Returning to the UK, our FRS data from September this year shows that at 6%, mass market investors are more likely to consider robo-advice than the 3% of affluent consumers (with £50-100,000 in savings and investments). Yet even among existing investors, the proportion who would prefer to buy their investments direct far exceeds those who do so.

This trend suggests that even for current investors, lack of confidence in buying direct is still a significant choke point and a barrier that robo-providers need to overcome.

This begs the question: if robo-investments do not serve to attract new investors to a market, can they fill the UK advice gap? Our research suggests that when the mass market group is deprived of a sales person to steer them through their investment decision, they stop buying investments and insurance. We will be tracking Nationwide, Barclays and other robo-providers through our FRS study over the next 6 to 12 months to identify which solution has the greatest traction with mass market investors.

However, the elephant in the room – and a crucial challenge to any robo-adviser – is how to stimulate demand for investments amongst mass market savers. Robo-advice and bionic solutions can certainly deliver low cost options for potential customers, but which model will succeed in creating demand?

Perhaps the industry needs to find a way to make mass market consumers more comfortable with these financial technologies, with top brands positioning robo and bionic advice as part of an omni-channel marketing approach.

Martin Grimwood

GfK Divisional Director – Life, Pensions & Investments