Private equity firms are reviewing more deals on average through the first quarter of 2016, according to updated data from Sutton Place Strategies. Catherine Daly and Nadim Malik from the firm reveal how the new data changes things from their Spring 2015 report.

Effective deal sourcing techniques have the potential to influence a fund’s performance. Identifying and committing to a clear strategy, that utilizes all requisite tools, could determine the success of a private equity firm’s closing rate. As discussed in the Science of Deal Sourcing 101 from the Spring of 2015, a private equity firm’s sourcing strategy directly impacts LPs who invest in private equity. In a highly competitive market, the best deal originators have the proficiency to be the best fund performers.

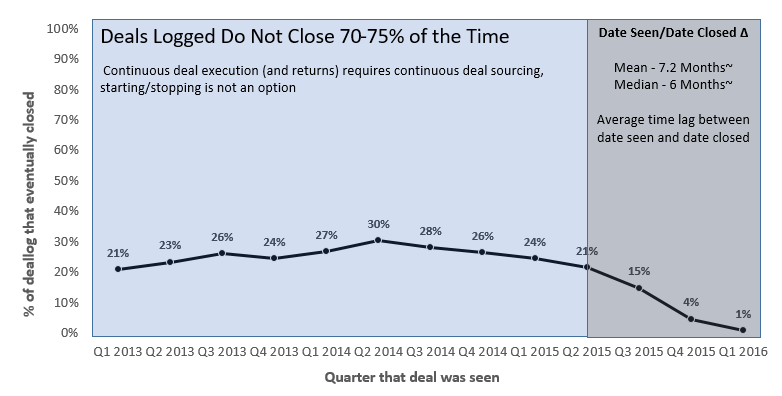

The crux of the Science of Deal Sourcing 101 was the realization that only 25 percent of a private equity firm’s logged deals, on average, actually traded. The consequence: an inefficient market, compounded by misuses of time, effort, and money. As noted in the previous article, there are various steps a firm can implement as part of the science of deal sourcing to improve its techniques. The most important steps include: devising internal metrics to continually assess performance, utilizing a CRM, and having dedicated business development professionals. In other words, the same techniques a private equity firm would require of its portfolio companies.

Sutton Place Strategies revisited the Science of Deal Sourcing 101 to update the original analysis through Q1 2016. Interestingly, as illustrated in the table below, at most 30 per cent of a private equity firm’s logged deals traded, signaling overall improvements in market efficiencies, combined with more effective deal sourcing strategies. The results also reveal that private equity firms are reviewing more deals on average. From these two developments, one could infer that the well-established processes employed by intermediaries are being shopped even more effectively. While it appears that the trend is sloping down from 30 per cent in Q2 2014, it is too early to determine if deals in more drawn-out processes will continue to close, resulting in a percentage increase in subsequent quarters.

The takeaway is clear, private equity firms are consistently reviewing more deals that are actually trading, which is the result of a more efficient and mature market. Yet, is this market efficiency an advantage for deal originators? If so, where are the opportunities to achieve a competitive edge? In an effort to answer these questions, SPS analyzed the activity of approximately 1,500 intermediaries over the last four years. Each of these intermediary’s closed deals were assigned one of three sell-side process classifications – Broad, Moderate, or Limited – based on the proportion of SPS clients that reviewed the transaction. Then, the thousands of transaction-level processes were aggregated up to the Intermediary to create a firm-level Sell-Side Process Index, the first scale of its kind. Finally, by categorizing the intermediaries into large-tier, mid-tier, and boutique (based on the number of deals closed) and utilizing the Sell-Side Process Index, SPS evaluated the data to determine potential sourcing opportunities.

Large-tier intermediaries represent those firms that averaged more than twenty deals per year, over the last four years. These large-tier firms were characteristically classified in the Broad range. Of the large-tier intermediaries identified, Harris Williams was the furthest to the right on the Sell-Side Process Index, joined by Duff & Phelps Securities, Lincoln International, Robert W. Baird, and William Blair & Co.

Intermediaries that closed between 4-20 deals per year are categorized as mid-tier. Of the 165 mid-tier intermediaries identified, 57 were in the Broad range, 91 were classified as Moderate, and 17 were on the Limited end of the scale. Interestingly, the majority of mid-tier intermediaries are employing Moderate sell-side processes, i.e. deals are not shopped too broadly, yet the firm is still a good source for repeat business. These intermediaries offer a great opportunity for deal originators to build long-term relationships, resulting in a higher return on time and capital invested. Furthermore, there is even greater potential with mid-tier intermediaries in the Limited classification. These firms are still closing 4-20 deals per year, yet their sell-side process is more controlled.

There were 1,298 boutique intermediaries that closed an average of 1-3 deals per year. According to the Sell-Side Process Index, nearly one-fourth of boutique intermediaries were in the Broad range and one-fourth were in the Moderate. However, as suspected, over 700 intermediaries, more than half of all boutiques, were in the Limited classification, creating an occasion for deal originators to source opportunities that are less competitive and not as heavily marketed. Also, boutiques provide an additional and interesting prospect for deal originators. When examining an independent analysis from 2013–2015, a substantial number of boutiques progressed towards the mid-tier category, thus offering an advantageous opportunity for deal originators to build early relationships and source more relevant deals over time.

By means of a proprietary algorithm, the Sell-Side Process Index classifies the type of closing process that intermediaries are employing (Broad, Moderate, Limited) on a relative basis. Private equity firms can utilize this rating to substantiate intermediary outreach, with reliable data, that supports their overarching strategic intent.

Despite the maturing and efficient market, opportunities exist to source relevant, undetected deals from boutique and mid-tier intermediaries, as well as take advantage of growing efficiencies in established processes. By creating and implementing a defined deal sourcing strategy, supported with actionable data, deal originators have the potential to positively impact fund performance. As market improvements emerge, the Sell-Side Process Index and analysis illustrates the multitude of available opportunities for deal originators. Stay tuned for next year’s analysis to see how the closing percentage of private equity deals logged progresses, and what the implications are for GPs and LPs.

Copyright © 2016 AltAssets