LP appetite for US mid-market funds is continuing a gradual decline amid investors consolidating their numbers of fund managers and a strong bias for megafunds.

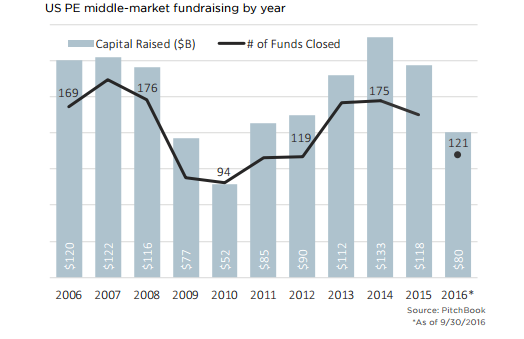

A total of $80bn was closed across 121 mid-market PE funds in the third quarter according to the latest research from PitchBook.

That total puts the sector on pace for the exact same number of fundraises as last year, albeit with a projected nine per cent drop in overall capital committed.

The report described those as “overall fairly strong figures”, but added that on a quarterly basis the value of LP contributions to the US mid-market had decreased each of the last three quarters, signaling some trepidation in the market.

“Further, the average time to close for a mid-market PE fund through 3Q 2016 was 17.7 weeks, up from 13.7 in 2015.

“It has taken managers a full month longer, on average, to close a fund this year.

“PEGs are still able to close, but timelines are being dragged out as LPs become more aggressive in the negotiation of fee discounts and co-investment opportunities.

“In addition, average middle-market fund size came in at $667m through 3Q 2016, down from $726m just two years ago.

“We believe the elevated multiples we’ve seen in the core mid-market (CMM) and upper mid-market (UMM) are causing managers to move down the EV spectrum.

“Therefore, we think the decline in median fund size can be attributed in part to the aforementioned shift in sourcing strategies.

“Industry giants outside of the middle market continue to raise outsized pools of capital, while traditional mid-market players are finding value through smaller, specialized vehicles.

“Subsequently, UMM-focused funds targeting between $1 bn and $5bn have made up just 17 per cent of final closes and 52 per cent of capital raised thus far in 2016, both well below the historical norm.”

Overall mid-market PE deal activity also continued to slow in the third quarter, the report said, following a similar trend as the wider PE marketplace.

The sector recorded $265bn in deal value closed across 1,330 transactions through the first three quarters, representing a 9.7 per cent year-over-year decrease in enterprise value and 16 per cent fall in the number of deals completed.

PitchBook said, “The drop-off in 2016 has been more pronounced in the middle market due to the lack of big-name transactions and deals with EVs of greater than $10bn that have been increasingly responsible for deal value figures above the upper middle market.

“Median deal size in the middle market through 3Q came in at $128.6m, down from $133m last year and $150m in 2014.”

Copyright © 2016 AltAssets