Latest Updates

Outlook for 2017

The populist wave crashing over the shores of the US and Europe still has much more to run, and whereas in the past we didn’t need to devote so much attention to the political environment in forming a view on private equity

Should DC Plan Sponsors Add Private Equity To Target-Date Funds?

In this paper, we studied how the inclusion of Private Equity in custom Target-date Funds (TDFs) affects the return profile of TDFs – more specifically, our approach focused on including Private Equity in TDFs while keeping their risk profile unchanged.

Pantheon promotes CFO Robin Bailey to partner

Global fund investor Pantheon has kicked off the new year with a wave of new promotions, including Robin Bailey to partner.

Pantheon promotes Corley to partner, makes senior level hires

Global fund investor Pantheon has bolstered its team with the promotion of Evan Corley (pictured) to partner and several senior level new hires.

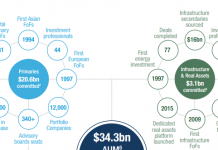

Pantheon: A leading investor in private markets

Pantheon was founded almost 35 years ago and is a leading investor in private markets with over $34.3 billion of assets under management across...

2016 Mid-Year Update

Global economic growth is currently running at just over 3% per annum, roughly the same pace as last year.

Hollyport buys Pantheon’s stake in IK 2004 Fund

Global secondaries specialist Hollyport Capital has tapped its fourth fund to buy a stakes in IK Investment Partners' 2004-vintage buyout fund.

Private equity performance: Carried interest and the persistence of quartile rankings

Private equity portfolios have the potential to create value for investors over many years. This feature reflects the relatively long-term nature of the asset...

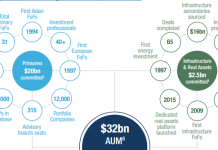

Q1 2016 – Pantheon: A leading investor in private markets

Pantheon was founded almost 35 years ago and is a leading investor in private markets with over $32 billion of assets under management across...

Outlook for 2016

The emergence of bubbles in asset classes or investment sectors is an inevitable consequence of near-zero real interest rates globally, not to mention large doses of quantitative easing.