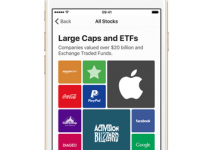

The millenial-market robo advisor is hoping Selling Plan will help it take advantage of public offerings in the tech space. Initial public offering (IPO) windfalls for engineers and other tech workers are not uncommon in Silicon Valley, but they often leave recipients with a diversification problem: a portfolio with a heavy concentration in one stock. To help solve it, Wealthfront, the automated investment platform, is creating another service traditionally reserved for human wealth managers. Employees at publicly traded companies can now use Wealthfront to sell the stock they receive in their company’s IPOs in an orderly fashion via Selling Plan—an automated service that lets employees either set the cash aside or reinvest it into a Wealthfront portfolio. Read more: wealthmanagement.com

Welcome!Log into your account