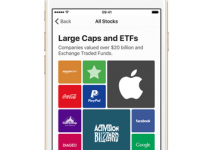

Hundreds of startups are trying to shake up the investment world with the so-called robo-advisor offering, and that is nothing new. The incumbents have not only taken notice but also embraced and latched on to the opportunity. Vanguard launched a robo-platform in 2015 and now manages $41bn in assets. Fidelity launched Fidelity Go, BBVA launched a robo-advisor in partnership with Future Advisor and others such as Charles Schwab and BLACKROCK aren’t lagging behind at all. We will come back to the effectiveness of each model next year but some people estimate that robo-advisors will account for more than 5% of investment portfolios by 2020. That is impressive and can get anyone in this space excited enough to leave their job at the incumbents and start on their own. Read more: letstalkpayments.com

Welcome!Log into your account