Scaling a challenger bank from the back to the front

Challenger banks start from a pretty grim position – most of them don’t have any customers. So how are they scaling? Read more: www.bankinginnovation.com

UK challenger bank Masthaven opens for business

Online-only Masthaven bank is promising an alternative to the one-size fits all approach of conventional banks as it opens its doors to customers in the UK. Read more: www.finextra.com

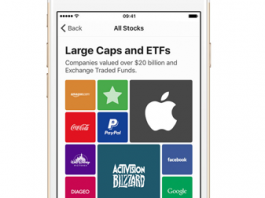

Freetrade pockets £1.1m on Crowdcube for stocks app

Stockbroking app Freetrade has smashed through its latest crowdfunding target to secure £1.1m in just 12 days. Read more: www.fintechroundup.com

A glimpse into hands-free banking

The industry of the internet of things is continuing to move towards personalizing everything. Read more: www.finextra.com

What we learned about robo-advisors

Robo-advisors are seen as competing with traditional financial planners, and provide online algorithm-driven advice without the use of human planners. Read more: www.letstalkpayments.com

Xiaomi-backed online bank to launch services soon

A Chinese online bank backed by smartphones and home appliances maker Xiaomi set to launch services soon. Read more: www.reuters.com

Robo-advisor ‘Chloe’ launches in Japan

Hong Kong-based social trading startup 8 Securities has launched a mobile-only robo-advisory service targeting the millennial generation. Read more: www.finextra.com

Citi FinTech launches first product for Citigold cardmembers

City FinTech has built a new mobile experience for Citigold card members that allows them to buy and sell funds and equities and transfer funds between accounts. Read more: www.techcrunch.com

Robo Adviser betterment stokes concern over Brexit trading halt

A decision by robo-advisory pioneer Betterment LLC to halt trading during the post-Brexit rout has stoked questions about the broad control some automated investment advisers maintain over clients’ ability to get in and out of markets during volatile periods. Read More: www.wsj.com

MoneyLion grabs $22.5m for personal finance management

Personal finance and lending platform MoneyLion has raised $22.5m in its Series A round. The funding was led by Edison Partners. Read more: www.fintechroundup.com