UK insurers say data they’ll want from driverless cars

Insurers are asking for a "basic set of core data" that will be shared in the event of an accident to help figure out exactly who should be liable. Read more: www.engadget.com

Four pitfalls to avoid in a cyberinsurance policy

As more companies enter the burgeoning cyberinsurance marketplace, they often ask how they can choose the best cyberpolicy. Read more: www.corpcounsel.com

Regulatory technology is a new remedy for emerging regulations

2016 has been a year of turbulence in the financial sector, with costly regulations impacting financial institutions (FIs) across the world. Read more: www.particlenews.com

New online bank Loot, run by a 22-year-old, launches

Loot offers a pre-paid card and a smartphone app that it says will ensure you will never overspend again. Read More: home.bt.com

3 reasons startup entrepreneurs love InsurTech

Most insurers now recognise the need and urgency to innovate, but significant challenges remain. Read more: www.propertycasualty360.com

Invoice fraud a problem for FinServ

Invoice fraud isn't just a problem for governments - financial services should combat it, too. Read more: www.pymnts.com

Insurers should claim recovery costs from manufacturers

Insurers should claim recovery costs from manufacturers of faulty driverless cars. Read more: insurtechnews.com

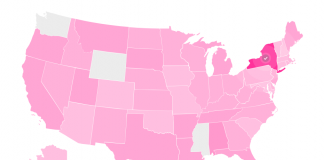

Lemonade to expand into 46 states

Lemonade is preparing to offer insurance to 97% of US citizens by filing for licenses in 46 states to offer homeowners/renters insurance. Read more: www.crowdfundinsider.com

Wellthie scores $5m to help brokers catch up in InsurTech

Tech provider for the insurance space Wellthie has raised $5m in a Series A round led by IA Capital Group. IA Capital Group led the round. Read more: www.fintechroundup.com

The rise of regulation in the InsurTech sector

The convergence of technology and regulation in the insurance sector is a topic of vital concern. Read more: techcitynews.com