Regulation is a space with a clear need for innovative new approaches to problems the very largest of financial institutions have grappled with for a long time.

As the regulatory requirements placed on institutions increase there is greater need for tech companies to offer solutions that can reduce costs and labour required to comply with changes.

This abundance of potential clients with deep pockets makes it a fertile sector for investors to place bets in.

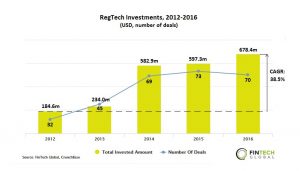

Investments in RegTech have grown more than three and a half times over the last five years, at a CAGR of 38.5%, according to data from fintech intelligence firm FinTech Global.

In total 2016 saw $678.4m poured into regtech startups with 70 deals completed – a record year in terms of volume of deals

The total amount invested resulted in a 13.6% year-on-year compared to 2015.

Orange Growth Capital founder and CEO Radboud Vlaar pointed to the actions of regulators “increasing scrutiny and requirements”, but noted that the space is still “fragmented” resulting in “a lot of cost for banks and pressure on the customer experience”.

He added: “As such it is a great place to attack with tech. There’s a big pool full of inefficiencies, it’s a big headache for clients and as such big gains can be made.”

New technologies around big data, machine learning and automation alongside a growing willingness among traditional institutions to implement startups’ technology mean that the investors are seeing a greater opportunity in the space than ever before.

London compliance startup ComplyAdvantage raised $8.2m from Balderton Capital in October, and founder and CEO Charles Delingpole highlighted the opportunity in the space saying: “It’s a hard problem that hasn’t been cracked.

“The incumbents tried for many years and they failed, but now there are technologies coming out like big data and machine learning, which are all being applied to this problem.”

2016 sees record investment in Q3

Last year saw two record quarters in regtech investments. The 21 deals completed during Q1 made it the most-active quarter for the space to date. The lower volume of capital invested during the period than during Q2 or Q3, however, illustrates the smaller size of the individual deals.

By contrast, Q3 saw a new record for the total amount invested in a single quarter with $305m invested in total.

This was boosted by several large deals, including the $96m raised by Avalara from Sageview Capital, TCV and Warburg Pincus, as well as the $40m taken on by Skyhigh Networks.

The notable downturn in Q4, when only $112.6m was invested across 12 deals, is reflective of investors’ reluctance to act in the wake of the American election.

Many deals were held off to allow investors to properly assess the market’s reaction to the vote, and regtech – perhaps more so than other fintech verticals – will be susceptible to the President’s promises to cut regulation for businesses.

The election’s results also suggest potentially turbulent times for regtech companies. Damian Kimmelman, co-founder and CEO of DueDil – a due diligence tool that has raised more than $22m form investors – said: “Trump has made it very clear that he’s going to unilaterally removing regulation with an axe.”

This could reduce the need for many regtech businesses, as companies in regulated industries are offered greater freedom.

Kimmelman suggested that while this “causes a tremendous opportunity for regulated US businesses in the short run”, he believes it will probably “cause a lot of harm long term for those industries.”

London leads as global deals hub

London’s status as European fintech capital and its position as a global hub for financial services of all types make it a fertile environment to build and grow regtech startups.

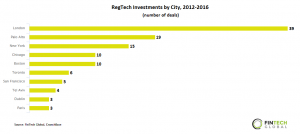

London saw more completed deals that any other individual city over the past five years with 33 deals completed – more than even the US tech heartlands of Palo Alto and San Francisco and the US financial centre of New York.

Overall, however, North America dominates with 228 deals completed since 2012.

Investors clearly identify London’s wealth of financial and technical talent, alongside a large existing pool of potential customers as a key factor for investment.

Investors and founders alike are also quick to highlight the vital role the forward-thinking actions of the local Financial Conduct Authority (FCA) is playing in enabling innovation across regulated industries and processes.

London-based startup Onfido also operates in the US, and the company’s development manager Jamie Miles claimed “it’s far more straightforward to build a regtech company in the UK.”

He highlighted the fragmented nature of the US, saying it is “the equivalent of trying to build a solution for the whole of Europe because all the different states have their own district regulators.”

He was also keen to praise the FCA, claiming that along with its equivalent in Singapore the body is “generally revered as the leading regulatory authority”.

Kimmelman added: “The regulators have been extremely thoughtful, values-based and not especially litigious. That creates a really friendly environment for regulated disruptors.”

Anti-Fraud solutions outstrip compliance

As it’s a relatively young sector for startup innovation new sub-sectors of focus continue to emerge in regtech, as experienced professionals from within industries set out to provide solutions to problems they’ve struggled with in traditional institutions.

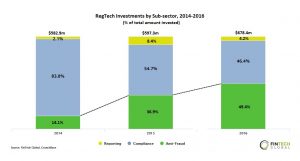

Over the past three years compliance has been the main focus for regtech investment, with companies in the space fetching the most amount of money with $1.1bn across 115 deals globally.

That accounted for 60.8% of the total invested since 2014. Anti-fraud technology, however, is becoming increasingly attractive to investors, overtaking compliance as the most-heavily invested in subsector.

Last year it made up 49.4% of the total volume invested, with $334.8m raised across 25 deals.

This coincides with increased machine learning implementations across tech, including applications of the technology to anti-fraud processes such as Know Your Customer (KYC) and Anti Money Laundering (AML).

As an essential part of traditional institutions’ operations investors can see clear paths for startups to attract high-profile clients that are increasingly willing to implement startups’ technology at scale.

“Over the past 20 years the greatest amount of disruption has been around unregulated industries,” said Kimmelman.

“Commerce and communications have been the hallmarks of most technological advances but the next 20 years of the disruption is around regulated industries such as finance, biotech, education, logistics.

“These companies all need some sort of contact with a regulator and they will scale very differently than the businesses that aren’t regulated.”

However, the space is still emerging and attracting a diverse range of approaches with none proven as significantly better than others. This means many investors are placing multiple bets within subsectors in the hope of backing an eventual winner.

“Regtech is going to be a very big area and whoever the winner is will have a sustainable business model because the law dictates that businesses like these need to exist,” said Miles.

“It doesn’t depend on preferences, it’s a very defensible investment and in that respect, you see VCs actually hedging their bets against multiple different approaches.”

London’s top companies raise more than $40m in 2016

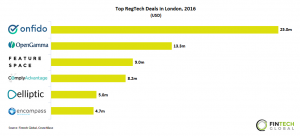

The most-active single city for regtech investment over the past five years, London’s largest rounds reflect the diversity of the sector.

Risk analytics startup OpenGamma’s $13.3m Series D round led by Accel Partners and ICAP was the largest in the city last year.

The city saw more than $40m raised collectively across the top five rounds, and other notable rounds went to fraud-prevention company Featurespace, which picked up $9m from TTV Capital.

The space is cash-intensive by its nature and Delingpole highlighted: “you can’t launch anything that’s half-baked, you have to invest a lot of money and time to get it up to standard.”

He added: “There’s a minimum viable standard of a company that’s very high. You have to spend a lot of money to build it before there’s any uptake.

Early-stage investors lead the way in deals

At present it is accelerators that lead the way in regtech investment, reflecting the early-stage nature of the space where 51.4% of deals in 2016 were Angel, Seed, Series A or B.

London’s presence is also felt strongly among the past five years’ most-active investors, with the top three all London-based accelerator programmes.

Startupbootcamp’s CEO Nektarios Liolios emphasised the emerging nature of the space, saying that “investment is not necessarily the best indicator at this stage” in the sector’s lifecycle.

He said: “It’s about allowing startups to validate their proposition to show that it works and that there is an industry capable of implementing what they see.”

Major VC firms Andreessen Horowitz and Iris Capital are also making moves in the space, where many startups operate SaaS business models similar to many of their other investments.

The regtech space on the whole is home to more early than late-stage companies but as these initial bets expand and scale the space will attract bigger rounds. Expect the kind of growth seen over the past five years to continue.

Liolios said: “Investment will follow. There aren’t that many late-stage regtech companies to invest in, give it a couple of years and it will be very different.”

Copyright © 2017 FINTECH GLOBAL